Welcome to

NHN Group

We have over 200 personnel ready to partner with your business today.

Proud to work with

Our services

We provide tailored client services specialising in security, investigations, labour hire, and strata cleaning for corporate, industrial and government sectors. We’re proud of our ability to deliver custom, streamlined management solutions that stem from our expert team and proven process.

Security Services

We have 20+ years of experience providing security guards to a range of diverse clients. Our team become an extension of your brand and an exemplary representative of your business.

Investigations

Our professional investigators and support personnel provide factual and surveillance investigative services for government, corporate and private clients.

Surveillance

Our surveillance operatives use modern technology to gather evidence for our investigations. We provide thorough and discreet background checks on targets before surveillance begins.

Labour hire

We have over 200 personnel with diverse skills that can fill labour gaps within your business. Our labour hire solutions are tailored and streamlined to your unique needs.

Commercial cleaning

We offer tailored commercial cleaning solutions for large corporate and strata cleaning projects.

Reliability

We build a relationship with our clients based on trust and communication.

Reputation

We’re known for our high-quality services and excellent results.

Professional

Our team become part of your brand and a representative of your business.

About NHN Group

At NHN Group, we support corporate, industrial, and government sectors with a number of integrated client services ranging from security and investigations through to labour hire, strata cleaning and process serving.

Our key point of difference is our ability to deliver custom, proven, and streamlined management solutions that stem from the expertise and processes of our team. We adapt our systems and processes to each client’s unique needs to ensure we’re delivering holistic solutions.

We’re a company built on core values — a foundation that distinguishes us and guides our actions. Our commitment to conducing our business socially and ethically sets us apart from most others in the industry. That’s why we integrate sustainable practices into everything we do, allowing us to build long-term value for our clients, shareholders, employees, and the wider community.

Enquire now

Leave us a message for more details about our general cleaning services.

Call us

If you’d prefer to speak to us directly, give us a call or request a callback.

We operate our business on “The 5 C’s”:

1

Client alignment

We take extra care to establish a strong relationship with our clients to ensure our services fit their unique business needs and our business values are aligned.

2

Compliance

We hold the appropriate licenses, insurance and ISO certifications to ensure our compliance practices protect our clients and our team.

3

Compatibility

The workforce we assign to your project is based on the compatibility checks we have in place to ensure we’re the right fit.

4

Communication

We maintain a high level of communication with our clients to keep them updated throughout all project stages.

5

Culture

We strive to continuously do better to deliver high-quality services, which is why we ensure our staff are well-trained and supported.

What our clients say

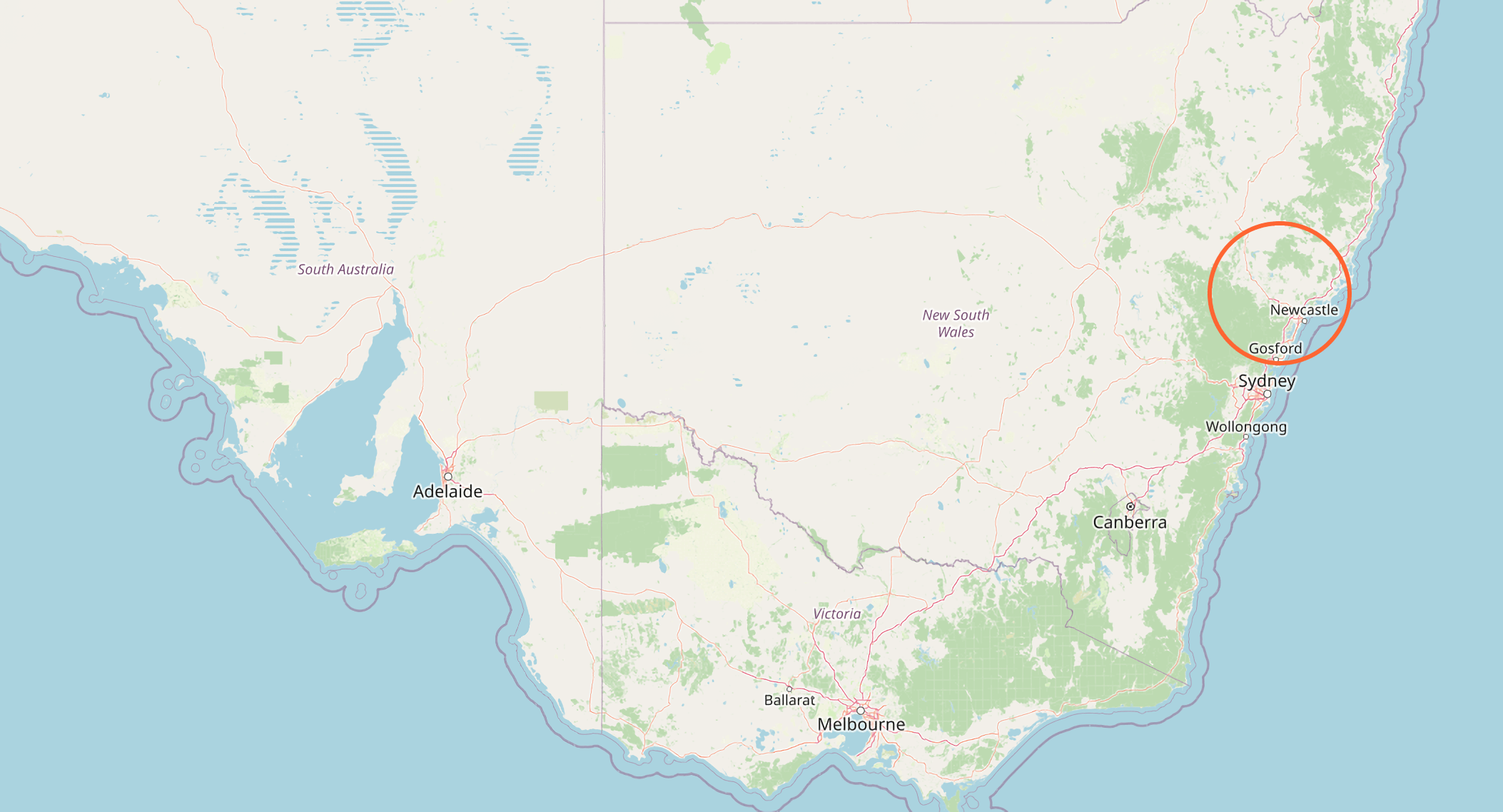

Areas we service

Our head office is located in Newcastle, allowing us to provide our services across Lake Macquarie, Port Stephens and Greater Hunter Region areas. We also have an office in Sydney.

Contact us

We support the community